Sterling Mortgage Income Fund Announces Special Distribution After Record Year

Paradise Island, The Bahamas — After a record year of strong returns, investors in Sterling Global Financial Limited’s mortgage income fund will soon get a special dividend in addition to their 7% annual preferred earnings that have been consistently paid quarterly throughout the life of the fund.

The Sterling Mortgage Income Fund posted a total yearly return of 12.6%, another strong showing by the 10-year-old fund that has achieved consistently solid returns for investors and exceeded volatile capital markets and economic shifts.

David Kosoy, Sterling’s Chairman and Founder, said it’s just the latest example of the fund protecting investor capital while boasting a stable and attractive income stream. Due to the strong performance in 2022, investors are now set to receive a special distribution of 5.6%*.

“We’re pleased to declare a special distribution for investors of the Sterling Mortgage Income Fund,” Kosoy said. “Through volatile capital markets and dramatic economic shifts, our portfolio weathered the changes of 2022 and once again added up to an impressive return for our investors.”

The strong performance and healthy portfolio of the fund, which actively invests in mortgages in the United States, Canada, the United Kingdom, The Bahamas and other select Caribbean countries, can be credited to Sterling’s focus on investing only in properties and sectors in which it has strong operational and construction capabilities. That focus, as well as the Sterling team’s proven expertise in real estate, has added up to profitable growth.

The current rising interest rate environment will benefit investors even more because the majority of loans are floating rates with a floor.

While investors can now look forward to a special distribution to the robust portfolio performance in 2022, they can also opt to maximize the value by reinvesting this dividend back into the fund — compounding their returns and setting themselves up for an increased total return in the long run.

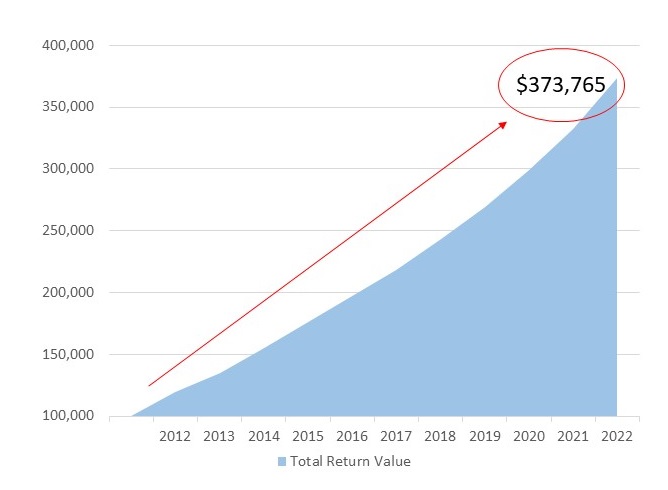

For example, because of a 12.10% net return over the past decade, someone who invested $100,000 at the fund’s inception and chose to reinvest their dividends would now have an investment worth more than $370,000.

SMIF CLASS A – GROWTH OF $100,000

The investment period is open and subscriptions are accepted monthly, with a minimum US$100,000 investment for qualified investors.

About Sterling Global Financial Limited

Sterling Global Financial Limited is a global alternative asset manager focused on real estate with more than 50 years of experience providing clients around the world with a range of services, including private banking, wealth management and real estate development, lending and trust services. Sterling has more than $9 billion in assets under management and administration and is a winner of prestigious awards for its real estate investment funds.

*For investors who have been invested in the fund for the full 2022 year.